It’s necessary to notice that an allowance for uncertain accounts is simply an knowledgeable guess, and your customers’ fee behaviors may not align. Bear In Mind that writing off an account doesn’t essentially imply giving up on receiving cost. In some cases, the company may still pursue collection by way of a group agency, legal motion, or other means.

Adjusting The Allowance

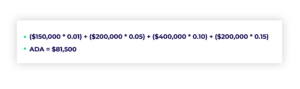

- For example, if there are $10,000 in present receivables and the chance of non-payment is 3%, the uncollectible quantity for current receivables can be $300.

- Beneath the direct write-off technique, the company calculates bad debt expense by determining a selected account to be uncollectible and instantly write off such account.

- When an account is set to be uncollectible, you debit the Allowance for Doubtful Accounts and credit Accounts Receivable.

- By categorising receivables based on their due dates, these reviews help determine potential risks and prioritise collection efforts.

- Backed by 2,700+ profitable finance transformations and a robust companion ecosystem, HighRadius delivers fast ROI and seamless ERP and R2R integration—powering the method forward for intelligent finance.

- The allowance for uncertain accounts is essential as a end result of it helps your accounting and bookkeeping groups generate extra correct financial statements that current a sensible view of your present assets.

Multiplying the default price with the total AR provides you with https://www.personal-accounting.org/ an estimate of unhealthy debt expense. For instance, a retail business analyzing five years of knowledge might discover that about 2% of credit score sales typically go unpaid. If this quarter’s credit gross sales whole $500,000, it would record a $10,000 addition to the allowance for uncertain accounts and a corresponding $10,000 dangerous debt expense. This accounting practice not only provides a extra correct picture of a company’s monetary health but additionally aligns with key accounting rules that govern monetary reporting. Understanding how businesses account for potential failures to pay makes how a agency manages danger far clearer.

These calculators automate the process by applying formulation to your data, ensuring you get consistent and dependable results. Many AR administration platforms, together with InvoiceSherpa, offer built-in tools to streamline this course of additional. Let’s use an instance to show a journal entry for allowance for uncertain accounts. The doubtful account steadiness is a results of a mix of the above two strategies. The threat method is used for the bigger purchasers (80%), and the historical method for the smaller clients (20%). Bad debt must be written off when it’s determined that a selected account receivable is uncollectible.

The allowance reserve is set within the period in which the income was “earned,” however the estimation occurs earlier than the actual transactions and clients could be identified. An account that lowers the worth of a connected account is called a contra account in a basic ledger. They can be utilized to report a lower or write down in a special contra account that nets the present e-book worth while sustaining the historical worth in the principle account. We note that accounts receivables are reported web allowances for uncertain accounts. For example, Colgate reports allowances for doubtful accounts as $54 million and $67 million in 2014 and 2013.

In the instance above, we estimated an arbitrary number for the allowance for doubtful accounts. There are two main strategies for estimating the amount of accounts receivable that aren’t expected to be transformed into money. Suppose a company generated $1 million of credit score gross sales in Year 1 however projects that 5% of those gross sales are very more probably to be uncollectible primarily based on historical expertise. This allowance helps your marketing strategy better and avoid surprises when a customer cannot pay. It’s often used along with accounts receivable, which tracks what your prospects owe you.

The allowance for uncertain accounts might sound too subjective or imprecise for accounting, but it’s more correct than pretending every bill might be paid in full. GAAP for the rationale that expense is acknowledged in a special interval as when the revenue was earned. GAAP allows for this provision to mitigate the risk of volatility in share price movements brought on by sudden changes on the steadiness sheet, which is the A/R stability in this context. Small businesses love this practice as a outcome of it keeps their income expectations real, and helps with everything from budgeting to deciding if that new espresso machine is a good idea.

Streamline Your A/r Processes At Present

OneMoneyWay is your passport to seamless global funds, safe transfers, and limitless opportunities for your companies success. Efficient administration of the allowance for uncertain accounts requires a well-trained group. Enhancing monetary processes and minimizing errors can be achieved by equipping employees with the required data and abilities. Your accountant’s busy estimating how a lot of that is simply expensive toilet paper. At the top of each period, replace your allowance with adjusting entries so your bills match revenue (hello, matching principle!). Sure, they take the primary punch if a customer ghosts, but when the BNPL provider collapses or chargebacks spike, you—the merchant—could nonetheless get burned.

Say you’ve obtained a complete of $1 million in AR, but you estimate that 5% of it, which is $50,000, might not come in. But, you’ll wish to do everything in your power to stop receivables from changing into uncollectible before issues get to that point. You can use your AR getting older report that will assist you calculate AFDA by making use of an anticipated default rate to each growing older bucket listed in the report. How you identify your AFDA may rely upon what’s thought-about typical fee habits in your industry.

There are three major ways for how to calculate unhealthy debt expense or estimate uncertain accounts. A contra-asset is an asset account with a adverse (credit) or zero account steadiness that shows the true worth of accounts receivable. The historic how to calculate allowance for doubtful accounts percentage method works best if you have a comparatively small customer base and straightforward billing cycles.

This determination is typically made after exhausting all reasonable collection efforts and assessing the client’s financial scenario. This technique categorizes accounts receivable primarily based on how long they’ve been excellent and applies different percentages to every class. In distinction, if allowance for uncertain accounts is overestimated, net accounts receivable will be artificially low.

An allowance for uncertain accounts can be referred to as a contra asset, because it’s either valued at zero or it has a credit score stability. In this context, the contra asset can be deducted from your accounts receivable belongings and could be thought-about a write-off. By analyzing such benchmarks, companies can make knowledgeable decisions about their method to managing their accounts receivable and avoiding potential monetary losses. There are various methods to determine allowance for doubtful accounts, every providing distinctive insights into the potential dangers your accounts receivable would possibly carry. Here’s a breakdown of the 2 main methods and some extra methods utilized by businesses for ADA formula and calculation. The amount is reflected on a company’s balance sheet as “Allowance For Doubtful Accounts”, within the property part, instantly below the “Accounts Receivable” line item.